We see a lot of partially and fully flooded homes here at Valley DRC, and insurance questions are among the top concerns our clients have.

Is Flood Insurance Necessary?

Standard homeowners and umbrella policies do not cover flood damage. Your home is your most valuable possession. Decide what your risk for flooding is and insure your home appropriately.

You may think that since you don’t live in a flood zone, you are safe. But 20% of all home floods claims happen to people who don’t live in a flood zone. Kitchen and bathroom floods, basement floods, ground water floods, broken sump pumps are all situations that are usually not covered in a home owner’s or renter’s policy.

Is Flood Insurance Expensive?

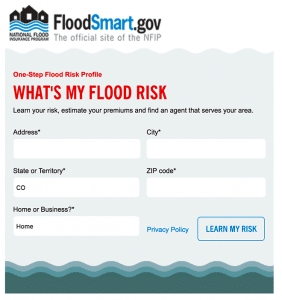

The price of federal flood insurance is based on the value of your home and if it is in a flood plain or not. Check out the estimated annual cost of flood insurance by entering your address at floodsmart.gov. You will get an instant assessment of your home or business’ risk for flood, and the average cost to insure your building.

If you live in a condo or rental, you can purchase flood insurance for only your possessions.

Plan ahead! Most flood insurance programs have a 30-day waiting period.

What does Flood Insurance Cover?

Flood insurance does not cover everything, so it’s important to know what your insurance covers and what it doesn’t.

Federal flood insurance policies cap coverage at $250,000 for the structure itself. The cap on personal possessions is $100,000 with the federal program.

Other things to keep in mind is that federal flood insurance pays the current value of possessions, not the cost of replacement. And if you have to live in a hotel room during renovations, that’s on your own dime.

Talk to your insurance agent about supplemental insurance if these caps concern you.

Remember, insurance is there to take care of you when a tragedy strikes, but if you don’t understand your coverage today, you could be in for a rude awakening if you are standing in three feet of water tomorrow.